Before I begin, please note I am not an attorney, nor am I an accountant, and the information currently available about the program I’m about to introduce is sketchy at best. Okay, with that disclaimer, let me tell you about something I recently discovered, something that sounds too good to be true, but from what I can tell, is completely legitimate.

In December 2017, the federal government passed a tax bill that paved the way for a new program called the Opportunity Zone program. Opportunity Zones correspond with census tracks and are designated by the state based on average income levels. It appears they are meant to replace the old Enterprise Zones.

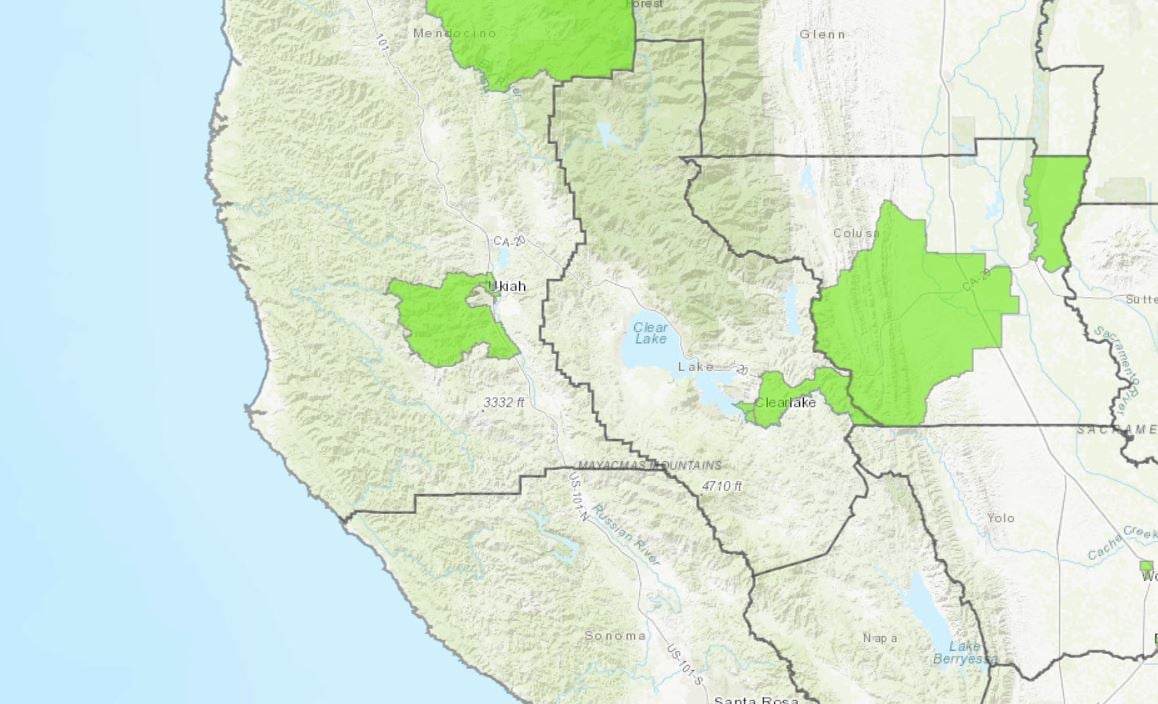

Based on my initial research, the Opportunity Zone program offers tax incentives to encourage investment in low-income communities, and the map I’m looking at indicates that much of the Ukiah Valley is an Opportunity Zone. Here’s how I believe they work.

Let’s say I bought a rental property in Ukiah back in the 1970s for $15,000. Now it’s worth $300,000. If I sell it outright and use the proceeds to purchase another investment property that happens to be in an Opportunity Zone, I can defer the capital gains tax on that sale. If I hold that new property for a minimum of 10 years before selling it, I will pay no federal income tax on the whole transaction. The entire sale is federally tax-free. Incredible!

Let’s do the numbers. Using the example above, let’s say you’ve decided to sell that rental you purchased in 1973. You sell it for $300,000 and use the proceeds to purchase a commercial building in an Opportunity Zone for $1,000,000. You hold the commercial building for 10 years and then sell it for $1,350,000 (a 3 percent annual appreciation) (increase in value of an asset over time).

If I understand the Opportunity Zone program, here’s how much you’d save in taxes. The total depreciation (decrease in value due to the aging of an asset) on the original rental was $12,000. The total depreciation on the commercial building was $170,000. The total appreciation of the rental was $285,000 and total appreciation on the commercial building was $350,000.

If the commercial building were not in an Opportunity Zone, you’d pay 25 percent in recapture taxes on the depreciation of both properties (amounting to $45,500) and 20 percent in capital gains taxes on the appreciation of both properties (amounting to $127,000). However, when you sell the commercial building after owning it for ten years in an Opportunity Zone, from everything I’m reading, it appears you pay nada, zero, zilch in recapture or capital gains taxes for either property.

Because this program is based on the average income in each census track, the communities that qualify may have a blend of high-value and low-value real estate. I have sent inquiries to the IRS to get clarification on the specifics of this program (e.g., Does it include land or is it just residential or commercial properties?), but have yet to hear anything back. However, from what I can tell, the potential benefits of investing in Opportunity Zones is staggering. This is why I couldn’t wait to write about it. As I learn more, I’ll be sure to pass the information along. In the meantime, if you are interested in reinvesting income from the sale of your existing real estate, take a look at an Opportunity Zone map. Visit http://dof.ca.gov/Forecasting/Demographics/opportunity_zones/ and scroll to the bottom of the page for links to interactive maps and other resources. This could save you a bundle of money.

If you have questions about real estate or property management, please contact me at [email protected] or call (707) 462-4000. If you’d like to read previous articles, visit my blog at www.richardselzer.com. Dick Selzer is a real estate broker who has been in the business for more than 40 years.